Who is Civil Society Organisation?

Government Organisations, Community Bases Organisations, Village Associations, Environmental Groups, Women’s Rights Groups, Farmers’ Association, Faith-based Organisations, Labour Unions, Co-operatives, Professional Associations, Chamber of Commerce, Independent Research Institutions & Non-profit Media.

Why is Tax Compliance Important?

- The success in taking forward the CSR initiatives lies in proper understanding of various compliance norms pertaining to GST and Income Tax.

- The Companies on their part have the resources to acquire the knowledge in this regard. The Civil Society Organisations (CSOs), who are major stakeholders, are hampered by resource crunch in acquiring the requisite knowledge.

- Failure to adhere to compliance norms is being viewed seriously by the Government and ignorance is never accepted.

- Excellent adherence to compliance norms improves the status of the organisation in the eyes of the donors and beneficiaries.

How can the workshop help?

CSR SPARK, being a platform for the Corporates and Implementing Agencies to meet, is playing an advisory role at present. Our first programme to discuss various aspects of section 135 of the Companies Act, was well received and has enabled various stakeholders in the CSR Environment to acquaint themselves of the CSR act, rules, notications and amendments.

CSR SPARK envisages enriching the CSOs in complying with various government norms in GST and IT, thus creating a strong and vibrant CSO base in this region.

Various aspects of the tax regime, which the CSOs ought to be familiar with, will be brought forward by our Eminent Faculty, Mr.K.Ravi, one of the experts in tax compliance. This will be followed up with a question & answer session.

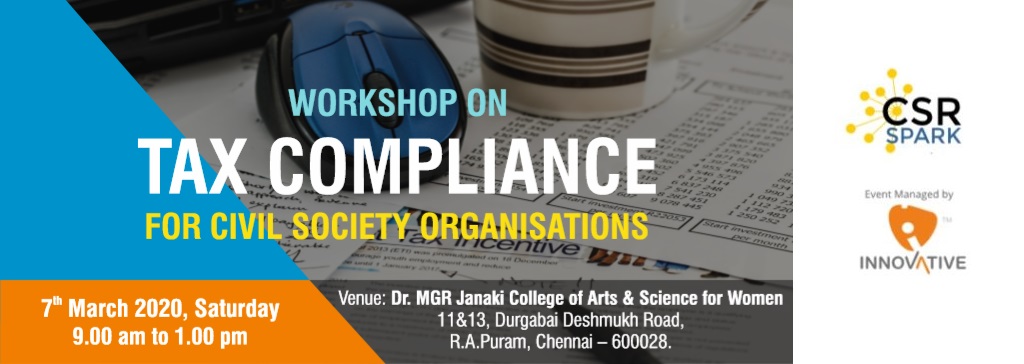

To take forward our advisory role, we are organising a “Workshop on Tax Compliance for Civil Society Organisations” on 7th March 2020, between 9.00 am and 1.00 pm.

CSOs are mandated to deliver the social goods being dispensed by the companies, so as to reach the beneciaries seamlessly.

ADHERE AND KEEP ADVANCING.

THE FACILITATOR:

Mr K RAVI, B Com FCA ACS Senior Vice President – Finance, Roots Group of Companies.

Mr. K.Ravi has three decades of experience in various fields such as, Corporate Finance, Accounts and Secretarial functions. Presently employed as Chief Financial Ofcer of Roots Group of Companies and Director in Roots Multiclean Ltd. He takes care of Finance, Accounts, Taxation (Both direct & Indirect) and Secretarial activities. He is the Member of the Apex Team for the Roots Group, which drives all management functions including strategic planning, formulation of various business strategies and responsible for taking key business decisions.

Mr.Ravi is a Member of Board of Studies in Bharathiar university, Sri Avinashilingam Deemed University, CMS College of Science & Commerce and Sri Saraswathy College of Arts & Science, Nirmala College for women and visiting faculty to CBE Branch of Institute of Chartered Accountants of India.

He was the Convenor of the Taxation Panel of Confederation of Indian Industry, CBE Zone 2006-2009. He is a Member of Auditors Association of Southern India and a Guest Faculty to Management Schools on topics related to Financial Management, Taxation (Direct & Indirect) and other Fiscal Laws.

Credentials:

- Best SICASA award for CBE branch of ICAI, during his Chairmanship in the year 1995-96.

- Best Branch award for Coimbatore Branch of ICAI during his Secretaryship in the year 1999.

- Produced students who secured All India first, second and fifth rank in CA examination and honoured with Faculty Award in recognition of service to the students.

- Appreciation letter from CMD of Roots Group on behalf of Board of Directors for the System implementation and Best Industrial practices conforming to Corporate Governance.

- Recipient of DJ BEST MANAGER AWARD from Coimbatore Management Association.

- Received prestigious award of ‘CFO India’s CFO100 Roll of Honour 2019’ (One among top 100 CFOs in India) in the 9th Annual Conference & felicitation ceremony held on 15th Mar 2019 at Mumbai.

Accomplishments:

As a Resource Person, presented papers on Taxation in the National Seminars organized by the Institute of Chartered Accountants of India, Confederation of Indian Industry and in various Academic Institutions & Management Schools. Addressed various seminars in Central Excise, Service tax and Income Tax organized by the Institute of Chartered Accountants of India, and Income Tax Departments. Have authored a book on “TDS in Tamil” along with co-authors, in the year 2004.